Introduction: The Brain-Fasting Connection for Traders

Have you ever noticed sharper trading decisions during morning hours before breakfast? The intermittent fasting cognitive benefits are gaining attention from neuroscientists and professional traders alike. This eating pattern might unlock unprecedented mental clarity for analyzing forex charts and cryptocurrency markets. Research suggests that fasting triggers specific hormonal pathways that enhance brain function.

Understanding intermittent fasting meaning is crucial before exploring its cognitive effects on trading performance. Furthermore, the connection between hunger hormones and alertness reveals fascinating insights for market analysis. Additionally, emerging evidence shows how fasted states influence split-second trading decisions that separate profitable traders from losing ones.

As a doctor and trader, I noticed my mind felt clearest in the morning before breakfast. During fasted hours, I focused better, read charts calmly, and made quicker decisions. Over time, I understood these intermittent fasting cognitive benefits were real. Hunger hormones kept me alert, reduced emotional trading, and improved discipline. This simple routine helped my trading performance without relying on stimulants.

What Is Intermittent Fasting?

Intermittent fasting represents an eating pattern alternating between fasting and eating periods. Unlike traditional diets, it focuses on when you eat rather than what you consume. The intermittent fasting schedule varies based on individual preferences, trading hours, and market session timing.

Common intermittent fasting time windows include:

- 16:8 method (16 hours fasting, 8 hours eating) – ideal for European and US trading sessions

- 5:2 approach (normal eating 5 days, restricted calories 2 days)

- Alternate-day fasting

- OMAD (one meal a day) – popular among full-time cryptocurrency traders

The intermittent fasting plan you choose should align with your trading schedule. Moreover, consistency matters more than perfection when starting. Therefore, forex traders monitoring multiple sessions often find the 16:8 method most sustainable.

The Science Behind Intermittent Fasting Cognitive Benefits

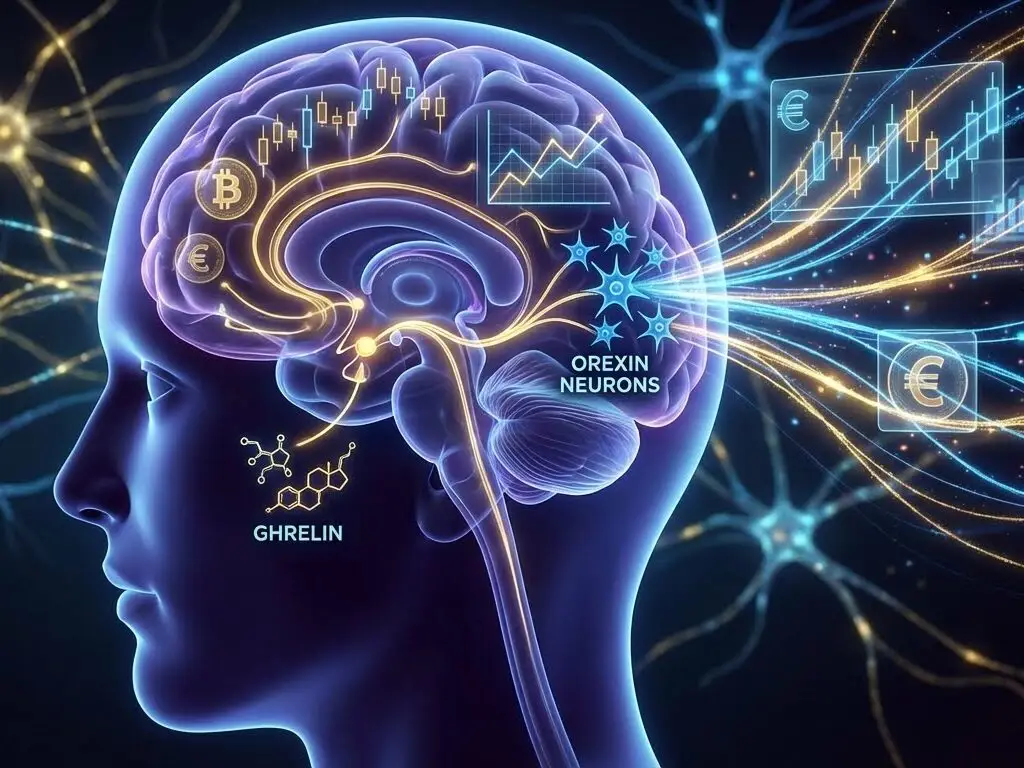

The Ghrelin-Orexin Pathway: Your Trading Edge

Ghrelin, known as the “hunger hormone,” does more than signal appetite. Research demonstrates it activates orexin neurons in the hypothalamus. These neurons regulate wakefulness, attention, and cognitive processing—critical factors when analyzing volatile crypto markets or identifying forex trading opportunities. Consequently, elevated ghrelin levels during fasting enhance mental alertness precisely when traders need maximum focus.

Orexin neurons project throughout the brain, influencing memory centers and decision-making regions. Studies show increased orexin activity correlates with improved focus and reaction times. Hence, the fasted state creates an optimal environment for executing trades and managing risk effectively.

You can read more about ghrelin’s neurological effects in this comprehensive study on PubMed: Ghrelin and Cognitive Function.

Metabolic Switching and Trading Performance

During fasting, your body undergoes metabolic switching from glucose to ketones. The brain efficiently utilizes ketone bodies as fuel. This metabolic shift provides sustained energy without glucose spikes and crashes that can lead to impulsive trading decisions. As a result, mental stamina increases throughout market sessions, allowing traders to maintain discipline during high-volatility periods.

Ketones also trigger brain-derived neurotrophic factor (BDNF) production. BDNF supports neuron growth and protects existing brain cells. Therefore, intermittent fasting benefits extend beyond immediate cognitive clarity to long-term brain health—essential for decades-long trading careers.

As a doctor, I clearly feel this metabolic shift while trading in a fasted state. My mind feels steady, not rushed. There are no energy crashes, so I stay patient during volatile moves. I think more logically and react less emotionally. During fasting, my focus lasts longer, and decision-making feels calm and controlled. This mental clarity helps me follow my trading plan with discipline, even in stressful market conditions.

Intermittent Fasting Benefits for Trading Decisions

Enhanced Executive Function in Market Analysis

The prefrontal cortex, responsible for complex decision-making, responds positively to fasting states. Professional forex and cryptocurrency traders report improved chart analysis during fasted periods. Similarly, reaction time tests show faster processing speeds in fasted individuals—crucial when markets move rapidly.

The intermittent fasting diet creates conditions that reduce decision fatigue. Mental clarity peaks when ghrelin levels are elevated during morning trading sessions. Subsequently, strategic thinking, pattern recognition, and risk assessment improve significantly. Traders can better identify support and resistance levels, recognize trend reversals, and execute entries with precision.

Reduced Emotional Reactivity in Volatile Markets

Fasting influences emotional regulation through neurotransmitter balance. Norepinephrine levels increase, promoting calm alertness during market turbulence. Meanwhile, impulsive reactions decrease during the fasted state. This combination proves invaluable when cryptocurrency prices swing wildly or forex pairs break critical levels.

Emotional discipline separates successful traders from those who blow accounts. The intermittent fasting cognitive benefits help maintain composure during drawdowns and prevent revenge trading after losses. Traders report better adherence to stop-losses and trading plans while fasting.

For more insights on fasting and emotional regulation, explore this research from Nature: Fasting and Brain Function.

Intermittent Fasting Weight Loss and Trading Performance Synergy

The connection between intermittent fasting weight loss and mental clarity is bidirectional. Weight reduction improves insulin sensitivity, which benefits brain function and trading stamina. Moreover, inflammation decreases as body composition improves. Consequently, cognitive performance continues enhancing over time, supporting better trading outcomes.

Intermittent fasting results typically manifest within 2-4 weeks. Initial benefits include increased alertness during market opens and improved concentration through multiple timeframe analysis. Long-term practitioners report sustained cognitive advantages alongside physical changes. Therefore, patience and consistency are essential for optimal trading performance outcomes.

Real-World Trading Applications

Forex Trading During Fasted States

Forex markets operate 24/5, presenting unique scheduling opportunities. Traders can align their intermittent fasting schedule with preferred trading sessions. European traders might fast through Asian sessions and break their fast before London opens. Conversely, US traders could fast overnight and through early European sessions.

The intermittent fasting cognitive benefits are particularly noticeable during:

- Major economic announcements (NFP, FOMC, GDP releases)

- High-impact news events requiring rapid analysis

- Complex multi-pair correlation analysis

- Risk-on/risk-off sentiment shifts

Cryptocurrency Trading in the Fasted State

Cryptocurrency markets never close, demanding exceptional mental endurance. Many successful crypto traders structure their intermittent fasting time around peak volatility periods. Bitcoin and altcoin price movements often accelerate during specific hours, requiring sharp focus.

Traders monitoring DeFi protocols, NFT markets, and emerging tokens benefit from enhanced pattern recognition during fasted states. The ability to process large amounts of on-chain data, social sentiment, and technical indicators simultaneously improves significantly.

As a doctor trading crypto, fasting has helped me stay mentally strong during long market hours. I handle sudden Bitcoin moves with more calm and less fear. While fasting, I notice better pattern recognition and faster understanding of price action. I’ve avoided impulsive entries and exits, especially during high volatility. This mental control has improved my consistency and reduced emotional losses in crypto trading.

Creating Your Intermittent Fasting Diet Plan for Trading

Structuring Your Eating Windows Around Market Hours

An effective intermittent fasting diet plan balances nutrient density with trading schedule timing. Begin with a 12-hour overnight fast, then gradually extend the fasting window. Hydration remains critical throughout fasting periods, especially during intense trading sessions. Additionally, electrolyte balance supports both physical and cognitive function during screen time.

During eating windows, prioritize:

- Healthy fats (omega-3s) for sustained energy and focus

- Quality proteins for neurotransmitter production

- Complex carbohydrates for glucose stability during trading

- Micronutrient-rich vegetables for eye health and cognitive function

- Adequate hydration to prevent decision-making impairment

Optimizing for Peak Trading Performance

Schedule your most important trading activities during peak fasting hours (typically 12-16 hours into the fast). Morning hours often provide maximum intermittent fasting cognitive benefits for analyzing overnight price action and planning daily trades. However, individual responses vary based on adaptation level and circadian rhythms.

Track your trading performance alongside your intermittent fasting schedule. Notice patterns in entry timing, risk management decisions, and profit-taking discipline. Subsequently, adjust timing to align with your most profitable trading hours. Many traders discover their win rate improves during specific fasting windows.

Intermittent Fasting and Heart Disease: Trading Longevity

While focusing on cognitive benefits for trading, cardiovascular health impacts career longevity. Research on intermittent fasting and heart disease shows promising results. Fasting improves multiple cardiac risk markers, including blood pressure and cholesterol levels. Nevertheless, individuals with existing heart conditions should consult healthcare providers before implementing any intermittent fasting plan.

The brain-heart connection means cardiovascular improvements support cognitive function during trading marathons. Better blood flow delivers more oxygen to brain tissue during intensive chart analysis. Thus, heart health and mental clarity are interconnected—both essential for sustained trading careers.

For detailed information on cardiovascular effects, review this comprehensive analysis from the American Heart Association: Intermittent Fasting and Heart Health.

Potential Considerations for Trading Professionals

Not everyone experiences immediate intermittent fasting cognitive benefits. Initial adaptation may include temporary brain fog or irritability that could affect trading performance. These symptoms typically resolve within 1-2 weeks as metabolic flexibility improves. Furthermore, gradual implementation reduces adaptation challenges while maintaining trading consistency.

Trading professionals should avoid intermittent fasting if they:

- Are pregnant or breastfeeding

- Have a history of eating disorders

- Take medications requiring food intake

- Experience severe stress or chronic sleep deprivation

- Are in peak competition or high-stakes trading tournaments

Start your intermittent fasting journey during low-volatility periods or while paper trading to assess personal response without risking capital.

Maximizing Your Intermittent Fasting Results for Trading Success

Success requires more than timing alone. Sleep quality dramatically affects both fasting outcomes and trading performance. Aim for 7-9 hours of quality sleep nightly to support memory consolidation and decision-making processes. Additionally, stress management techniques complement fasting’s cognitive benefits during losing streaks.

Combine your intermittent fasting plan with:

- Regular physical activity (walking between trading sessions)

- Meditation or mindfulness practices for emotional control

- Strategic caffeine consumption during market opens (if tolerated)

- Adequate hydration throughout trading hours

- Blue light management for optimal circadian rhythm

Trading Strategies Enhanced by Fasting

Pattern Recognition and Technical Analysis

Traders report enhanced ability to spot chart patterns during fasted states. Support and resistance levels become more apparent. Fibonacci retracements, Elliott Wave counts, and harmonic patterns are easier to identify. The intermittent fasting cognitive benefits seem to enhance visual processing and pattern matching.

Risk Management and Position Sizing

Perhaps most importantly, fasting improves risk management discipline. Traders make more calculated position sizing decisions and better honor stop-loss levels. The reduced emotional reactivity prevents overleveraging and revenge trading—two behaviors that destroy trading accounts.

Multi-Timeframe Analysis

Analyzing price action across multiple timeframes demands significant cognitive resources. Traders practicing intermittent fasting report less mental fatigue when switching between 1-minute scalping charts and daily swing trading timeframes. This sustained focus throughout trading sessions translates directly to improved profitability.

Conclusion: Trading Hunger for Market Edge

The evidence supporting intermittent fasting cognitive benefits continues growing, particularly for trading professionals. The ghrelin-orexin connection provides a biological basis for enhanced mental performance during fasted states. Whether you’re analyzing forex pairs, trading cryptocurrency volatility, or managing complex options positions, strategic fasting may sharpen your competitive edge.

Remember that individual responses vary significantly among traders. Start conservatively with your intermittent fasting schedule and adjust based on trading results. Monitor both subjective experiences (focus, emotional control) and objective performance metrics (win rate, profit factor, adherence to rules). Ultimately, the best approach is one you can sustain while achieving your cognitive and trading goals.

The intersection of neuroscience and trading performance reveals that sometimes the best trading advantage comes not from better indicators or strategies, but from optimizing the most important trading tool—your brain.

Medical Disclaimer

This article is for informational purposes only and does not constitute medical advice. The information regarding intermittent fasting cognitive benefits, intermittent fasting diet plans, and related topics should not replace professional medical consultation. Individual health conditions vary, and what works for one person may not be suitable for another.

Before starting any intermittent fasting schedule or making significant dietary changes, consult with qualified healthcare providers. This is especially important if you have pre-existing medical conditions, take medications, or have concerns about intermittent fasting and heart disease. The author and publisher are not responsible for any adverse effects or consequences resulting from the use of suggestions or information presented herein.

Always seek the guidance of your physician or other qualified health professional with any questions regarding your health or a medical condition. Never disregard professional medical advice or delay seeking it because of information you have read in this article.

This article does not constitute financial or trading advice. Trading forex and cryptocurrencies involves substantial risk of loss and is not suitable for all investors. Past performance does not guarantee future results.

Author: Dr. Nirosh