Introduction: The Silent Brain Killer in Trading

Does fear control your trades despite having solid strategies? Cortisol trading stress might be physically damaging your brain’s command center. Professional traders lose fortunes not from poor analysis but from stress-induced cognitive impairment. The “scared money” mindset isn’t weakness—it’s biology attacking your prefrontal cortex.

Understanding how cortisol trading stress affects decision-making is crucial for survival. Chronic stress literally shrinks your brain’s executive function area. Moreover, this damage occurs silently while you focus on charts and positions. Therefore, protecting your cognitive hardware becomes as important as protecting trading capital.

As a doctor and trader, I’ve felt cortisol take over during high-volatility sessions. Even with a solid strategy, I’d hesitate or exit trades too early out of fear. Over time, I noticed that fasting, proper sleep, and short mindfulness breaks helped me calm my stress response. My focus improved, and I could trust my analysis rather than reacting emotionally. Protecting mental clarity became just as important as protecting my account balance.

What Is Cortisol Trading Stress?

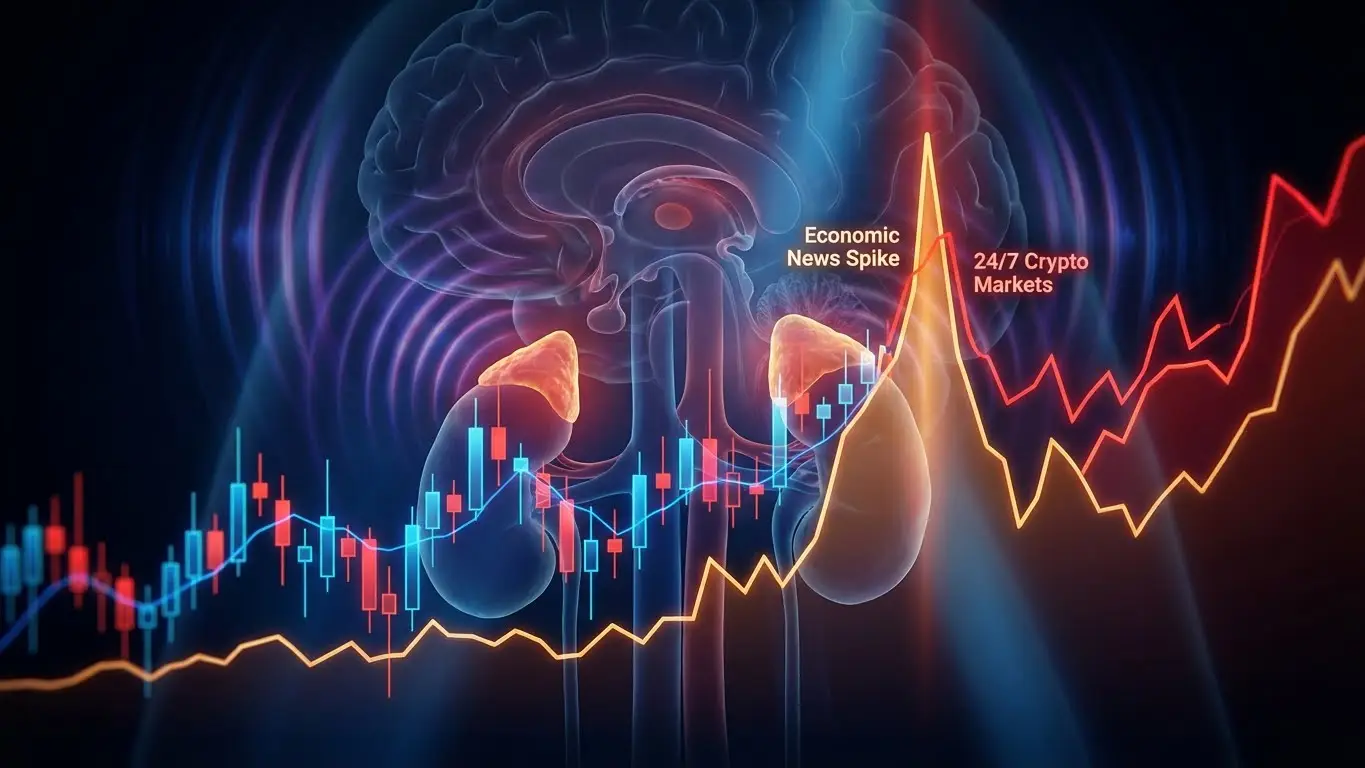

Cortisol serves as your body’s primary alarm hormone. Your adrenal glands release it during challenges or threats. Trading creates unique stress patterns that trigger constant cortisol production. Forex traders face stress during economic announcements. Cryptocurrency traders experience 24/7 pressure without relief.

The cortisol trading stress response evolved for short-term physical dangers. However, modern markets trigger identical pathways without resolution. Consequently, cortisol levels remain elevated for hours or days. This chronic exposure causes devastating neurological damage over time.

Understanding Cortisol Trading Stress Hormone Level

Normal cortisol follows a healthy daily rhythm. Levels peak early morning to promote wakefulness. They decline throughout the day, reaching minimum at night. Trading disrupts this natural pattern completely.

Market opens trigger cortisol spikes that should resolve quickly. However, position monitoring maintains elevated levels for hours. The cortisol trading stress hormone level stays dangerously high without adequate recovery. Chronic elevation eventually damages your prefrontal cortex permanently.

Several methods measure your stress hormone accurately:

- Saliva testing throughout trading days

- Blood tests during peak market hours

- Hair analysis for long-term exposure patterns

- 24-hour urine collection for total output

Early detection enables intervention before permanent brain damage occurs.

How Cortisol Trading Stress Shrinks Your Brain

The Prefrontal Cortex: Your Trading Command Center

Your prefrontal cortex (PFC) handles all complex trading decisions. It manages risk assessment and emotional control. Additionally, it processes probability calculations and maintains discipline. Professional traders rely heavily on strong PFC function.

Chronic cortisol trading stress directly attacks this critical region. MRI studies show measurable shrinkage in stressed traders’ brains. The damage occurs through three mechanisms:

Neuronal Death: Sustained cortisol kills brain cells faster than regeneration. Your decision-making capacity diminishes progressively.

Dendritic Retraction: Neurons possess branch-like extensions enabling communication. Stress causes these branches to shrink and withdraw. Processing speed slows during crucial trading moments.

Reduced Neurogenesis: Stress hormones suppress new neuron formation. Your brain loses its ability to adapt and learn from mistakes.

For comprehensive research on stress-induced brain changes, explore this detailed study on the National Institutes of Health website at PubMed.ncbi.nlm.nih.gov, where neuroscientists document how chronic cortisol exposure reduces prefrontal cortex volume by up to 20% in high-stress individuals.

Cortisol Trading Stress Hormone Side Effects

Immediate Cognitive Impairment

Elevated cortisol impairs critical trading functions instantly. Decision-making speed slows dramatically under stress. Risk assessment becomes increasingly inaccurate. Emotional control weakens, leading to impulsive decisions.

The cortisol trading stress hormone side effects manifest quickly:

- Difficulty analyzing multiple timeframes simultaneously

- Hesitation on valid trade setups

- Premature profit-taking from fear

- Holding losing positions hoping for recovery

- Analysis paralysis preventing execution

Long-Term Brain Damage

Chronic exposure creates permanent structural changes. Prefrontal cortex volume decreases measurably over months. Neural connections deteriorate, reducing processing capacity. Memory consolidation fails, preventing learning from past mistakes.

Traders experiencing these effects struggle despite knowledge and experience. Their damaged brain hardware cannot support optimal performance. Strategy quality becomes irrelevant when execution hardware fails.

During high-stress trading periods, I noticed tension headaches, a tight jaw, and constant mental fatigue. My focus would waver, and I often replayed mistakes in my mind without learning from them. Even simple calculations felt harder, and I became irritable and impatient. It was clear that stress wasn’t just psychological—it physically drained my brain, making disciplined trading almost impossible until I managed my cortisol levels.

The “Scared Money” Mindset Explained

Biological Roots of Trading Fear

“Scared money don’t make money” reflects neurological truth. This mindset emerges from cortisol-induced brain damage, not character weakness. Your amygdala (fear center) becomes hyperactive under stress. Meanwhile, the shrinking prefrontal cortex loses control over fear responses.

This creates a vicious biological cycle. Fear triggers cortisol release damaging your PFC. The damaged PFC cannot regulate fear effectively. More fear generates additional cortisol causing further damage.

Scared money traders exhibit predictable patterns:

- Cutting winners early despite valid price action

- Avoiding setups after previous losses

- Reducing position sizes excessively

- Overanalyzing until opportunities disappear

- Revenge trading to recover losses quickly

Understanding this biological basis removes shame and enables targeted intervention.

Cortisol Trading Stress in USA: Market Realities

American traders face unique stress challenges. Markets open when cortisol naturally peaks in morning hours. This timing amplifies stress responses beyond normal levels. Additionally, high leverage availability increases anxiety substantially.

Economic data releases create intense pressure moments. Non-Farm Payroll and FOMC meetings trigger massive volatility. Cortisol trading stress in USA reaches extreme levels during these events. Professional traders report heart palpitations and excessive sweating.

Cryptocurrency adoption adds another stress dimension. Many US traders hold positions through Asian sessions. Sleep disruption compounds cortisol dysregulation, creating dangerous health consequences. The 24/7 nature prevents necessary recovery periods.

Cortisol Trading Stress Management: Immediate Strategies

Professional traders employ specific protocols to lower cortisol quickly:

Breathing Exercises: Deep diaphragmatic breathing activates calming nervous system responses. Practice 4-7-8 breathing technique between trades. Inhale for 4 seconds, hold for 7 seconds, exhale for 8 seconds. This reduces cortisol trading stress management needs within minutes.

Physical Movement: Brief exercise breaks clear stress hormones effectively. A 10-minute walk significantly lowers cortisol levels. Stretching releases muscle tension maintaining elevated stress hormones.

Sensory Grounding: The 5-4-3-2-1 technique interrupts stress spirals. Identify 5 things you see, 4 you feel, 3 you hear, 2 you smell, 1 you taste. This practice shifts attention from internal stress to external reality.

To understand the neuroscience behind these techniques, read the comprehensive guide on stress physiology at the American Psychological Association website (APA.org), where researchers explain how simple interventions can reduce cortisol by 25-40% within 20 minutes.

Cortisol Trading Stress Relief: Long-Term Solutions

Sleep Optimization

Prioritize 7-9 hours of quality sleep nightly. Sleep deprivation amplifies cortisol responses dramatically. Establish consistent sleep-wake schedules even on weekends. Dark, cool sleeping environments support proper cortisol regulation.

Meditation Practice

Regular meditation reverses stress-induced brain shrinkage. Just 20 minutes daily promotes prefrontal cortex regeneration. Mindfulness meditation proves particularly effective for traders. It enhances emotional regulation while reducing baseline anxiety.

Exercise Regimen

Aerobic activity reduces cortisol while increasing brain-protective factors. Aim for 30-45 minutes of moderate exercise daily. Morning workouts before trading sessions provide optimal cortisol trading stress relief protection.

Cortisol Trading Stress Balance Through System Design

Position Sizing for Mental Peace

Risk management directly impacts stress hormone levels. Position sizes should never cause sleep loss or anxiety. Professional traders typically risk 0.5-1% per trade maximum. This conservative approach provides psychological safety.

Calculate positions based on volatility and personal tolerance. Account drawdowns become manageable when losses stay small. Reducing financial fear lowers cortisol production substantially.

Automated Trading Systems

Algorithmic approaches reduce decision-making stress significantly. Predetermined entry and exit criteria eliminate emotional choices. Backtested systems provide confidence during inevitable drawdowns. Automation frees your prefrontal cortex from constant monitoring.

Many successful traders combine discretionary and systematic approaches. They use algorithms for execution while maintaining strategic oversight. This hybrid model optimizes cortisol trading stress balance effectively.

In my friend’s experience, using algorithmic trading drastically reduced stress. He relied on backtested systems for entries and exits, which removed impulsive decisions and calmed his mind during drawdowns. To complement this, he took short breaks, practiced deep breathing between trades, and limited screen time during volatile sessions. Combining automation with strategic oversight allowed him to stay alert, focused, and emotionally balanced, improving both performance and overall well-being.

Cortisol Trading Stress Reactivity: Individual Differences

Stress reactivity varies considerably among individuals. Some people produce more cortisol under identical conditions. Genetic variations in stress receptors influence responses. Understanding your personal cortisol trading stress reactivity helps optimize strategies.

High-reactivity traders benefit from:

- Smaller position sizes than peers

- Longer timeframes reducing decision frequency

- Strict trading hour limitations

- More aggressive stress management protocols

Low-reactivity traders may handle higher stress temporarily. However, they still face brain damage from chronic elevation.

Cortisol Trading Stress Research: Latest Findings

Recent studies reveal concerning patterns among active traders. A 2024 study found day traders show cortisol comparable to emergency physicians. Cryptocurrency traders exhibit even higher stress markers.

Longitudinal cortisol trading stress research demonstrates measurable cognitive decline after 3-5 years. However, studies also show reversal potential through intervention. Traders implementing comprehensive protocols recover prefrontal cortex volume within 6-12 months.

For the latest scientific findings on stress and cognitive function, explore research published in Nature Neuroscience journals at Nature.com, where longitudinal studies track how sustained cortisol elevation in traders leads to measurable prefrontal cortex atrophy, but also document complete reversal through targeted stress management interventions.

Nutrition for Cortisol Balance

Specific nutrients support healthy cortisol regulation:

Omega-3 Fatty Acids: EPA and DHA reduce inflammatory stress responses. Fish oil supplementation (2-3 grams daily) protects brain structure.

Magnesium: This mineral regulates stress hormone production. Supplementation (300-400mg daily) improves stress balance significantly.

Vitamin C: High doses (1000-2000mg daily) lower cortisol levels. This antioxidant protects neurons from stress damage.

Adaptogenic Herbs: Ashwagandha reduces cortisol by up to 30%. Rhodiola improves stress resilience and performance. Holy basil normalizes cortisol rhythms over time.

Blood Sugar Stability

Glucose fluctuations trigger unnecessary cortisol release. Eat balanced meals with protein, fats, and complex carbohydrates. Avoid excessive caffeine exceeding 200mg daily. Limit refined sugars creating energy crashes.

Building a Low-Stress Trading Environment

Your physical environment influences cortisol significantly:

- Natural lighting reduces cortisol production

- Ergonomic furniture prevents physical discomfort

- Plants and greenery lower baseline anxiety

- Cool temperatures enhance cognitive function

- Quiet spaces reduce unnecessary distractions

Professional firms invest heavily in environmental design. Individual traders should similarly optimize workspaces.

Conclusion: Protecting Your Trading Brain

Cortisol trading stress represents a serious threat to trading careers. Chronic stress doesn’t just affect emotions—it physically damages your prefrontal cortex. The scared money mindset has biological roots in brain shrinkage.

However, this damage is not permanent. Implementing stress management strategies reverses prefrontal cortex atrophy. Meditation, exercise, sleep, and nutrition promote brain recovery. System design modifications reduce unnecessary stress exposure.

Your brain represents your ultimate trading edge. Protect it as carefully as trading capital. Sustainable success requires maintaining cognitive function across decades. Prioritize stress management with dedication equal to market analysis.

Remember that trading is a marathon, not a sprint. Winning the stress battle ensures long-term viability. Your prefrontal cortex health determines whether you’ll trade successfully in 10 years—or burn out after stressful months.

Medical Disclaimer

This article is for informational purposes only and does not constitute medical advice. Individual health conditions vary significantly, and what works for one person may not be suitable for another. Before implementing any stress management protocols, dietary changes, supplementation regimens, or making significant lifestyle modifications, consult with qualified healthcare providers. This is especially important if you have pre-existing medical conditions, take medications, experience severe stress symptoms, or have concerns about cortisol levels and brain health.

Always seek the guidance of your physician or other qualified health professional with any questions regarding your health or a medical condition. Never disregard professional medical advice or delay seeking it because of information you have read in this article. The author and publisher are not responsible for any adverse effects or consequences resulting from the use of suggestions or information presented herein.

This article does not constitute financial or trading advice. Trading forex, cryptocurrencies, and other financial instruments involves substantial risk of loss and is not suitable for all investors. Past performance does not guarantee future results. The stress management techniques discussed are meant to support overall health and well-being, not to guarantee trading success.

Author: Dr. Nirosh