Successful trading is often described as a battle of wits. However, the true battle occurs within your own brain. To master trading psychology, you must first master the neurochemistry of trading. Most retail traders fail because they ignore the biological signals. These signals lead to poor financial decision-making.

In this article, we will perform a “Neuro-Financial Audit.” We will explore how your hormones dictate your PnL. Understanding these chemical shifts is the only way to achieve sustainable trading performance.

The Role of Dopamine in the Neurochemistry of Trading

Dopamine is the primary driver of the neurochemistry of trading. It is the molecule of anticipation. It is not the molecule of pleasure. When you see a setup forming, your brain releases dopamine. This chemical creates a “high.” This high can easily cloud your judgment.

This process is the foundation of The Trader’s Dopamine Loop. If you do not break this cycle, you will eventually trade for the “hit.” You will stop trading for the profit.

From my experience, this is very true. When I see a good setup, I feel excited even before entering the trade. That excitement sometimes makes me rush, ignore my rules, or overtrade. I realized that I was chasing the feeling, not the profit. Only when I learned to slow down and control this urge did my trading become more disciplined and consistent.

My friends and I noticed something interesting. We often felt more excited while waiting for a trade than after winning one. This is the dopamine loop in action. If you don’t control this, you will overtrade. You will do this just to feel that spark again.

The Amygdala Hijack and Your PnL

When your trades go wrong, another part of the neurochemistry of trading takes over. This is the Amygdala. It triggers the “fight or flight” response. This sudden surge of chemicals leads directly to Revenge Trading.

I remember a friend who lost a month’s gains in ten minutes. He wasn’t a bad trader. He just had an amygdala hijack. His brain was trying to “fight” the market. He wanted to get his money back immediately. He didn’t realize his biology was working against him.

Cortisol: A Key Part of the Neurochemistry of Trading

While dopamine gets you into a trade, cortisol usually gets you out too early. Cortisol is the body’s primary stress hormone. It is a fundamental part of the neurochemistry of trading. When a trade moves against you, your cortisol levels spike.

This spike makes your heart rate increase. Your breathing becomes shallow. Suddenly, you are no longer a rational investor. You are a scared animal trying to survive. Chronic high cortisol physically shrinks your prefrontal cortex. This is the area of the brain responsible for logical planning.

Conducting Your Neuro-Financial Audit

To improve your trading performance, you need a daily audit. This means checking your physical state before clicking “buy.”

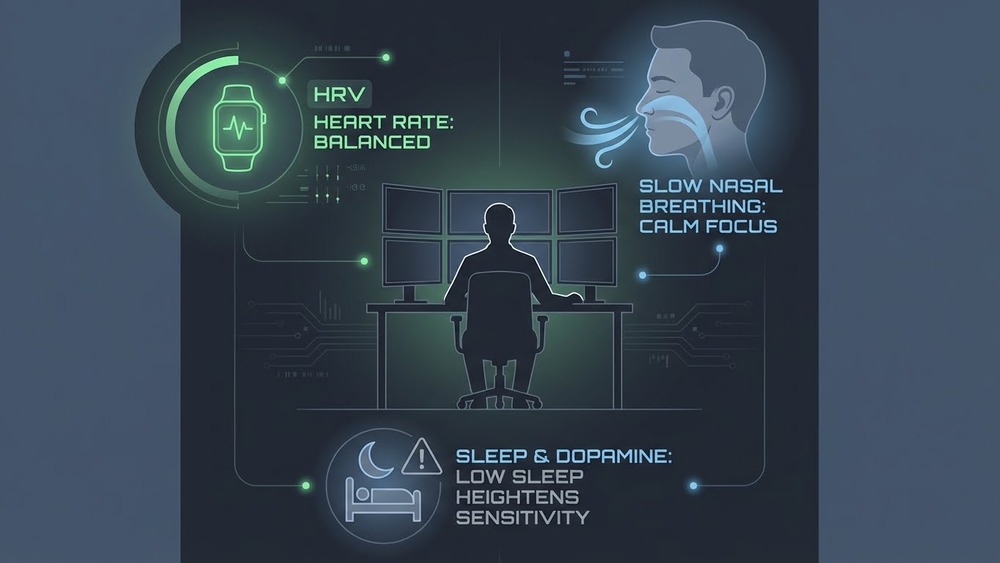

- Check Your Heart Rate: Use a wearable device to track Heart Rate Variability (HRV). High HRV means your neurochemistry of trading is balanced.

- Monitor Your Breath: If you are breathing through your mouth, you are likely in a stressed state.

- Evaluate Your Sleep: Lack of sleep increases dopamine sensitivity. This makes you more likely to gamble.

Using Nootropics to Balance the Neurochemistry of Trading

You can actively shift the neurochemistry of trading using specific protocols. The 4-7-8 Breathing Technique is a medical tool. It helps to lower heart rate instantly. Additionally, certain supplements like L-Theanine can buffer the effects of caffeine.

Furthermore, you should consider your environment. Noise and blue light increase stress. A clean, quiet station helps maintain a neutral chemical state. My friends and I started using blue light glasses. We noticed much less brain fog by the end of the day.

External Resources for Deep Learning

- Harvard Health: Understanding the Stress Response – Learn how cortisol and the amygdala interact during high-stress situations like market volatility.

- National Institutes of Health (NIH): The Dopamine Reward System – A scientific look at how dopamine influences impulsive behavior and risk.

- Psychology Today: The Neurobiology of Risk – Explains why the human brain is not naturally wired for modern financial trading.

Conclusion: Biology is Your Edge

Most people look for a better indicator. You should look for a better biological state. The neurochemistry of trading determines your success more than any chart pattern. Start your audit today. Watch your breath. Track your heart rate. Stay in control of your brain. If you do, you will stay in control of your capital.

Medical Disclaimer: The information provided in this article is for educational and informational purposes only and is not intended as medical advice. Always seek the advice of a qualified healthcare provider regarding any medical condition or treatment. Never disregard professional medical advice or delay in seeking it because of something you have read on this website.

Author: Dr. Nirosh