Trading the financial markets requires a razor-sharp mind. You need to process complex data, manage emotions, and execute orders with precision. Many traders rely on coffee to maintain this edge. However, a hidden biological clock could be sabotaging your success. Understanding the relationship between caffeine half-life and trading performance is the key to sustainable profitability. If you drink coffee too late, you sacrifice REM sleep. When you lose sleep, your PnL usually follows it down the drain.

I used to drink coffee late at night to trade. I felt active at night, but the next day I was tired, impatient, and made bad trades. I overtraded and ignored my stop-loss. After I stopped late-night coffee, my sleep improved and my trading became calmer and more consistent.

The Science of Caffeine Half-Life and Trading

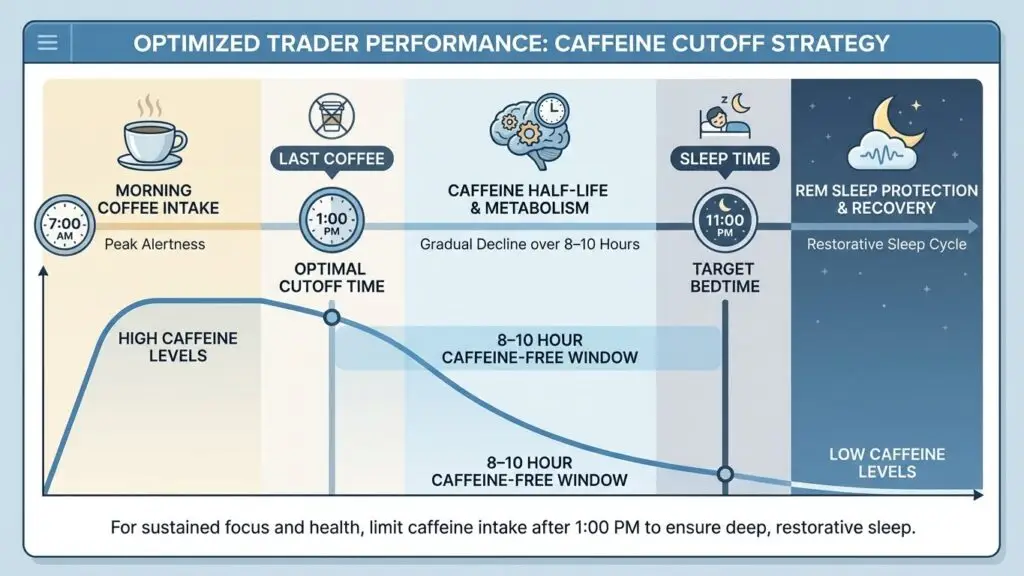

To master your performance, you must understand how your body processes stimulants. The half-life of caffeine is approximately five to six hours for the average adult. This means if you consume 200mg of caffeine at 4:00 PM, you still have 100mg in your system at 10:00 PM. Caffeine works by blocking adenosine receptors in your brain. Adenosine is the chemical that builds up throughout the day to make you feel sleepy.

When you prioritize caffeine half-life and trading awareness, you realize that “feeling” awake isn’t the same as being rested. Even if you fall asleep, the caffeine remains active. It prevents you from reaching the deep, restorative stages of sleep.

Why REM Sleep is a Trader’s Greatest Asset

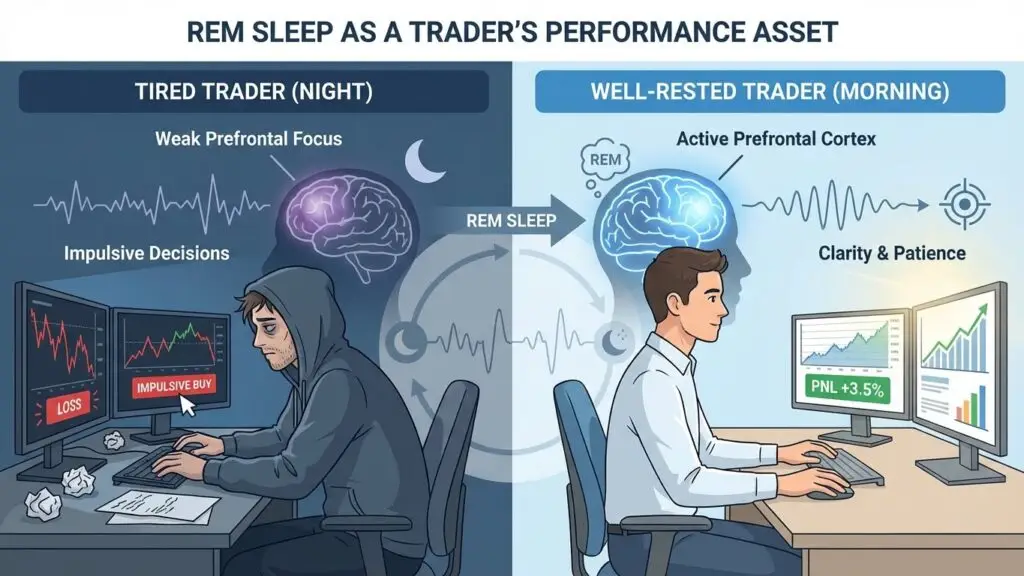

Rapid Eye Movement (REM) sleep is vital for cognitive function. During this stage, your brain processes emotions and consolidates memories. For a trader, REM sleep is where “market intuition” is built. It helps you recognize patterns and stay calm under pressure.

Lack of REM sleep leads to “revenge trading” and poor risk management. Your prefrontal cortex weakens without rest. This part of the brain controls logic and impulse. If you ignore the caffeine half-life and trading balance, you are essentially trading while chemically impaired. You become more prone to clicking “buy” when you should stay flat.

On days after poor sleep, I notice my discipline is low. I chase trades, increase lot size, and break my rules. My PnL usually suffers. When I sleep well, I trade less, wait for clean setups, and protect my capital.

Calculating Your Caffeine Cutoff Time

When exactly should you stop drinking coffee? To protect your REM sleep, you should aim for a “caffeine-free” window of at least 8 to 10 hours before bed. If you plan to sleep at 11:00 PM, your last sip of coffee should be no later than 1:00 PM.

This strict cutoff ensures that the caffeine half-life and trading impact is minimized. By the time your head hits the pillow, the remaining caffeine levels will be low enough to allow your brain to enter deep REM cycles.

The 10-Hour Rule for Peak Performance

* Identify your bedtime: Consistency is key for your circadian rhythm.

* Count back 10 hours: This is your hard “no-caffeine” deadline.

* Switch to decaf or herbal tea: Satisfy the ritual without the stimulant.

The Psychological Trap: Caffeine and Overtrading

Traders often use caffeine to mask boredom or fatigue. During slow market hours, you might reach for a second or third cup. This creates a dangerous cycle. The extra caffeine increases your heart rate and cortisol levels. High cortisol makes you feel anxious. An anxious trader is an impulsive trader.

By focusing on caffeine half-life and trading health, you break this cycle. You learn to manage your energy with hydration and movement instead of chemicals. You will find that your entries are cleaner when your nervous system is calm.

Implementing the “TheDopamineDoc” Strategy

As we discuss on my platform, managing your neurochemistry is as important as managing your stop-loss. High dopamine seeking—often fueled by caffeine—leads to over-leveraging. You must view caffeine as a tool, not a crutch. Use it for the London or New York open, but respect the clearance time.

Integrating the caffeine half-life and trading protocol into your daily routine will change your equity curve. You will wake up with mental clarity. You will handle losses with more emotional stability. Most importantly, you will stop making “tired” mistakes that eat your profits.

My medical view:

Traders struggle with stimulant use because markets reward excitement and fast decisions. Dopamine feels like an edge, but too much of it removes discipline. Long-term profitability comes from calm focus, not constant stimulation.

Common Pitfalls to Avoid

Many traders think a “quick espresso” during the afternoon slump won’t hurt. They are wrong. Hidden sources of caffeine also play a role. Dark chocolate, soda, and certain headache medications contain enough caffeine to disrupt sleep.

Always check the labels to maintain your caffeine half-life and trading standards. If you feel a slump at 3:00 PM, try a 10-minute walk or a cold glass of water. These methods boost alertness without the 6-hour chemical lingering effect.

Summary for the Professional Trader

Successful trading is a marathon, not a sprint. You cannot sustain high-level performance on four hours of caffeinated sleep. Respect the biology of your brain. Stop your caffeine intake early in the afternoon. Protect your REM sleep at all costs.

When you master caffeine half-life and trading, you gain a competitive advantage over the thousands of sleep-deprived traders in the market. Better sleep leads to better decisions. Better decisions lead to a better PnL.

My final thought as a doctor

My trading improved when I treated sleep as part of my risk management. By respecting my body, I became calmer, more patient, and more consistent. A healthy trader is a profitable trader.

Medical Disclaimer

This content is for informational and educational purposes only. It is not intended to provide medical advice or to take the place of such advice or treatment from a personal physician. All readers/viewers of this content are advised to consult their doctors or qualified health professionals regarding specific health questions. Neither Dr. Nirosh nor the publisher of this content takes responsibility for possible health consequences of any person or persons reading or following the information in this educational content. All viewers of this content, especially those taking prescription or over-the-counter medications, should consult their physicians before beginning any nutrition, supplement or lifestyle program.

Author: Dr. Nirosh