Heart Rate Variability: Your Secret Weapon for Trading Success

HRV for trading is revolutionizing how professional traders approach their daily market activities. Heart rate variability (HRV) measures the variation in time between consecutive heartbeats, providing crucial insights into your autonomic nervous system’s balance. Consequently, this metric reveals whether your body and mind are primed for the high-stakes decisions required in crypto and forex trading. Moreover, understanding your HRV can mean the difference between profitable trades and costly emotional mistakes.

”As a medical doctor working in critical care and cardiology, I first encountered HRV not on a trading desk, but in the ICU monitoring patient stability. I realized that the same physiological ‘fight or flight’ response that prepares a doctor for a trauma case was triggered every time I sat down to scalp the markets. I started tracking my own metrics and noticed a pattern: my worst trading losses almost always occurred on days when my physiological data showed high stress, even if I ‘felt’ fine emotionally. This bridged the gap for me between medical physiology and trading psychology.”

What Is Heart Rate Variability and Why Traders Should Care

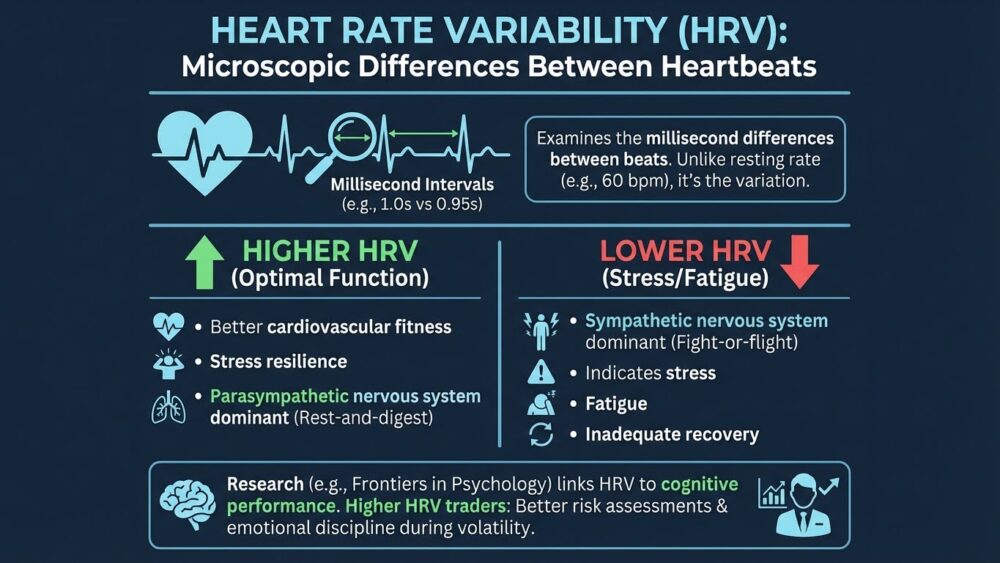

Heart rate variability represents the microscopic changes between each heartbeat interval. Unlike your resting heart rate, which might be 60 beats per minute, HRV examines the millisecond differences between beats. For instance, one interval might be 1.0 seconds while the next is 0.95 seconds.

Higher HRV typically indicates better cardiovascular fitness and stress resilience. Additionally, it suggests your parasympathetic nervous system (rest-and-digest mode) is functioning optimally. Conversely, low HRV signals that your sympathetic nervous system (fight-or-flight mode) is dominant, indicating stress, fatigue, or inadequate recovery.

Research published in the Frontiers in Psychology journal demonstrates that cognitive performance, including decision-making speed and accuracy, correlates strongly with HRV levels. Therefore, traders with optimal HRV make better risk assessments and maintain emotional discipline during volatile market conditions.

The Science Behind HRV for Trading Performance

Your autonomic nervous system controls involuntary bodily functions, including heart rate regulation. Trading demands intense focus, rapid pattern recognition, and emotional control—all governed by your nervous system’s state.

Studies from Harvard Medical School reveal that stress and poor sleep dramatically reduce HRV. Furthermore, reduced HRV impairs prefrontal cortex function, the brain region responsible for rational decision-making. This explains why exhausted traders often chase losses or abandon their trading plans.

”I recall a specific instance after a grueling 24-hour on-call shift at the hospital. I was physically exhausted, and my Whoop strap showed my HRV was 40% below my baseline. Ignoring the data, I opened a high-leverage crypto position because the chart looked ‘perfect.’ My reaction time was sluggish, and when the trade moved slightly against me, my sympathetic nervous system (adrenaline) spiked instantly. Instead of sticking to my stop-loss, I froze—a classic ‘amygdala hijack’—and ended up losing 4R on a single trade. That loss wasn’t due to lack of skill; it was physiological sabotage.”

The sympathetic-parasympathetic balance directly affects:

- Reaction time to market movements

- Emotional regulation during drawdowns

- Pattern recognition capabilities

- Risk assessment accuracy

- Discipline adherence

How to Measure HRV for Trading Readiness

Recommended Electronic Devices

Several validated devices accurately measure HRV for trading assessment:

- WHOOP Strap 4.0: This wearable provides continuous HRV monitoring with detailed recovery scores. Additionally, it tracks sleep stages and offers personalized recommendations.

- Oura Ring (Gen 3): The discrete ring format delivers comprehensive HRV data without wrist discomfort. Moreover, its sleep analysis helps identify recovery obstacles.

- Polar H10 Chest Strap: Considered the gold standard for HRV accuracy, this chest strap pairs with numerous apps. Subsequently, it provides medical-grade measurements.

- Apple Watch (Series 4 and newer): Built-in HRV tracking through the Health app offers accessible monitoring. However, chest straps provide superior accuracy for serious traders.

- Elite HRV App with Compatible Devices: This dedicated application interprets HRV data specifically for performance optimization. Furthermore, it offers trend analysis and readiness scores.

Interpreting Your HRV for Trading Decisions

Understanding HRV metrics requires establishing your personal baseline. Track measurements consistently for 2-4 weeks upon waking, before checking markets.

Optimal Trading Days (High HRV)

- HRV above your personal average

- Strong recovery score (typically 70%+)

- Good sleep quality (7-8 hours)

- Action: Execute your full trading strategy, including complex setups

Moderate Trading Days (Average HRV)

- HRV near your baseline

- Adequate recovery score (50-70%)

- Decent sleep (6-7 hours)

- Action: Focus on high-probability setups only, reduce position sizes

Rest Days (Low HRV)

- HRV significantly below baseline (15%+ decrease)

- Poor recovery score (below 50%)

- Insufficient sleep or high stress

- Action: Avoid active trading, review past trades, or paper trade

”I have implemented a strict rule based on my medical understanding of cognitive fatigue: If my HRV drops by more than 15% of my monthly average, I am ‘medically unfit’ to trade live funds. On these days, I treat my trading desk like a sterile field where I am not scrubbed in. I will review charts and backtest, but I do not click ‘Buy’ or ‘Sell.’ This discipline alone saved me from substantial losses during a stressful period of balancing hospital shifts and business startups.”

Improving Your HRV for Trading Performance

Evidence-Based Strategies

Research from the American Heart Association identifies several proven HRV optimization methods:

- Sleep Optimization: Maintain 7-9 hours of quality sleep. Additionally, consistent sleep schedules regulate circadian rhythms, improving HRV by 10-15%.

- Breathing Exercises: Resonant frequency breathing (typically 5-6 breaths per minute) activates the vagus nerve. Therefore, practicing 10 minutes daily increases HRV significantly.

- Regular Exercise: Moderate aerobic exercise (3-5 times weekly) enhances cardiovascular fitness. Subsequently, this improves baseline HRV over weeks.

- Stress Management: Meditation, yoga, and mindfulness practices reduce cortisol levels. Moreover, 20-minute daily sessions show measurable HRV improvements within two weeks.

- Nutrition and Hydration: Omega-3 fatty acids, magnesium, and proper hydration support autonomic balance. Consequently, dietary improvements reflect in HRV measurements.

- Alcohol and Stimulant Management: Alcohol consumption significantly suppresses HRV for 24-48 hours. Similarly, excessive caffeine intake disrupts autonomic balance.

Integrating HRV for Trading Into Your Routine

Create a systematic morning protocol:

- Measure HRV immediately upon waking (before phone/market checks)

- Log your reading in a tracking app or journal

- Assess your readiness score based on personal baselines

- Adjust trading plan accordingly (full engagement, reduced activity, or rest)

- Note correlations between HRV and trading performance.

”My morning ritual is non-negotiable. Before I even look at the Asian session highs or lows, I check my Oura ring data. If the score is green, I proceed to my ‘DopamineDoc’ trading journal. If the score is red, I immediately do a 10-minute resonant breathing session (6 breaths per minute) to try and stimulate the vagus nerve. If the score doesn’t improve, I step away. Treating my biology as the primary indicator—before technical indicators like RSI or MACD—has been the single biggest edge in my career.”

Professional crypto traders report 20-30% performance improvements when respecting HRV-based readiness signals. Furthermore, they experience fewer emotionally-driven mistakes during drawdown periods.

Common Mistakes When Using HRV for Trading

Traders often misinterpret HRV data initially. Avoid these pitfalls:

- Comparing your HRV to others: Individual baselines vary tremendously.

- Single-day overreactions: Trends matter more than isolated readings.

- Ignoring context: Illness, travel, or life stress affects HRV independently.

- Measurement inconsistency: Take readings same time daily, same conditions.

- Overriding signals: Trading despite poor HRV undermines the system.

Advanced HRV Strategies for Professional Traders

Elite forex and crypto traders use HRV in sophisticated ways:

- Position Sizing Adjustments: Scale position sizes proportionally to HRV status. Accordingly, high-readiness days allow normal risk, while moderate days reduce exposure by 50%.

- Strategy Selection: Employ complex multi-leg options strategies only on optimal HRV days. Conversely, use simple trend-following approaches during lower-readiness periods.

- Team Trading Environments: Proprietary trading firms incorporate HRV monitoring into desk management. Subsequently, traders rotate high-intensity roles based on daily readiness.

The Future of HRV for Trading

Emerging technologies promise enhanced HRV integration:

- Real-time HRV monitoring during trading sessions

- AI-driven correlations between HRV patterns and trade outcomes

- Biofeedback training for rapid HRV improvement

- Wearable alerts when HRV drops below trading thresholds

Research institutions continue exploring HRV’s predictive capabilities for cognitive performance. Therefore, expect increasingly sophisticated applications in professional trading environments.

Conclusion

HRV for trading represents a paradigm shift from purely technical analysis toward holistic performance optimization. By monitoring this physiological metric, you gain objective insights into your daily readiness for high-stakes decision-making. Moreover, respecting your body’s signals prevents costly emotional trading while maximizing performance during optimal states.

The most successful crypto and forex traders understand that consistent profitability requires more than chart patterns and indicators. Consequently, they treat themselves as performance athletes, using tools like HRV monitoring to maintain their competitive edge.

Start measuring your HRV tomorrow morning. Track it consistently for one month while noting correlations with your trading results. You’ll likely discover patterns that transform your approach to market participation.

”In medicine, we say ‘vital signs don’t lie.’ The same is true in trading. Your chart might lie, your ‘gut feeling’ might be biased by FOMO, but your HRV is an objective truth about your biological capacity to handle risk. Embracing this data transformed me from a reactive gambler into a disciplined risk manager. Start listening to your heart—literally.”

Medical Disclaimer

This article provides general information about heart rate variability and its potential applications for trading performance. It is not intended as medical advice, diagnosis, or treatment. The information presented should not replace consultation with qualified healthcare professionals. Individual health conditions vary significantly, and what works for one person may not be appropriate for another. Before making significant changes to your exercise routine, sleep patterns, or stress management practices based on HRV measurements, consult your physician or a qualified healthcare provider. This is especially important if you have existing cardiovascular conditions, take medications affecting heart rate, or experience any concerning symptoms. The devices and strategies mentioned are for informational purposes only and do not constitute endorsements or medical recommendations.

Author: Dr. Nirosh