Overtrading psychology is one of the biggest silent account killers in trading. Many traders do not lose because of bad strategies. Instead, they lose because their mind takes over. Fear, dopamine, revenge, and stress push traders to trade more than they should.

I have seen this again and again. I have lived it myself. My trading friends have lived it too. At first, it looks harmless. Then it destroys discipline. Finally, it destroys accounts.

In this article, we will break down overtrading psychology, why it happens, and how traders can regain control.

What Is Overtrading Psychology?

Overtrading psychology refers to the mental and emotional forces that push traders to take too many trades. These trades are often unplanned. They are emotional. They are impulsive.

Overtrading psychology is not about greed alone. Instead, it is about dopamine, stress, fear, and the brain’s reward system.

Traders feel the urge to act. Traders feel the need to recover losses fast. Traders feel uncomfortable doing nothing.

Doing nothing feels painful.

Why Overtrading Psychology Is So Powerful

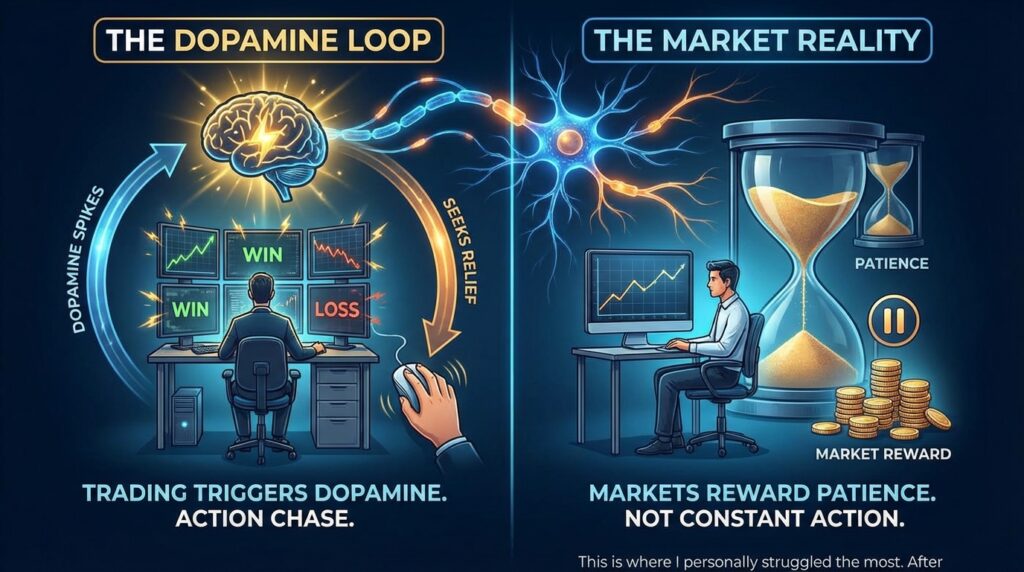

The brain is wired for rewards. Trading triggers dopamine. Dopamine makes us feel good. Dopamine also makes us chase more action.

Here is the problem. Markets do not reward constant action. Markets reward patience.

Overtrading psychology becomes powerful because:

- Dopamine spikes after wins

- Losses create emotional pain

- The brain seeks relief through more trades

Because of this, traders click again. Then again. And again.

This is where I personally struggled the most. After a loss, I felt physical discomfort. Taking another trade felt like relief. Many of my trader friends admitted the same thing.

Common Signs of Overtrading Psychology

You may be suffering from overtrading psychology if you notice these signs:

- You trade outside your plan

- You feel anxious when not trading

- You increase position size after losses

- You revenge trade

- You feel mentally exhausted after sessions

These signs often appear slowly. They feel normal at first. Later, they become destructive.

How Overtrading Psychology Destroys Accounts

Overtrading psychology hurts traders in multiple ways.

First, it increases transaction costs.

Second, it reduces focus and decision quality.

Third, it creates emotional burnout.

Most importantly, it breaks trust in yourself.

Once trust is broken, discipline collapses.

I have seen skilled traders fail not because they lacked knowledge, but because overtrading psychology hijacked their behavior.

Dopamine and Overtrading Psychology

Dopamine plays a huge role in overtrading psychology. It is not the pleasure chemical. It is the anticipation chemical.

Each trade creates expectation.

Each setup creates hope.

Each click promises reward.

When dopamine spikes too often, impulse control drops. The trader stops waiting for high-quality setups.

This cycle is similar to behavioral addiction. That is why stopping feels hard.

You can learn more about dopamine and behavior here:

👉 https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3032992/

(This explains how dopamine influences decision-making and impulse control.)

How Stress Makes Overtrading Worse

Stress amplifies overtrading psychology. When cortisol rises, the rational brain weakens. Emotional reactions increase.

Traders under stress:

- Misread charts

- Ignore rules

- Seek fast relief

Stress and overtrading feed each other. One creates the other. Then the loop continues.

This is why stress management is essential for trading performance.

👉 https://www.apa.org/topics/stress

(The American Psychological Association explains how stress affects judgment and behavior.)

Proven Ways to Control Overtrading Psychology

Controlling overtrading psychology requires structure. Motivation alone is not enough.

Here are methods that work.

1. Set a Trade Limit Per Day

Limit the number of trades. When the limit is reached, stop. This removes decision fatigue.

2. Use Mandatory Breaks

After each trade, step away for 5–10 minutes. This lowers dopamine spikes.

3. Journal Every Trade

Writing slows the brain. Journaling exposes emotional patterns.

This helped me a lot. My friends noticed that once emotions were written down, urges lost power.

4. Focus on Process, Not P&L

Process builds discipline. P&L fuels emotion.

5. Improve Sleep and Physical Health

Poor sleep increases impulsive behavior.

👉 https://www.sleepfoundation.org/how-sleep-works

(Sleep quality strongly affects emotional regulation.)

My Experience With Overtrading Psychology

I want to share something personal here.

I once believed I had iron discipline. Then I hit a losing streak. My trading plan disappeared. I clicked impulsively. My friends did the same. We talked about it later.

We realized the problem was not strategy. It was overtrading psychology.

Once we added trade limits, breaks, and journaling, performance improved. More importantly, stress reduced.

Final Thoughts on Overtrading Psychology

Overtrading psychology is not weakness. It is biology. It is stress. It is dopamine.

The goal is not to trade more.

The goal is to trade better.

Once traders understand overtrading psychology, control becomes possible. Discipline returns. Confidence stabilizes. Accounts survive.

Medical Disclaimer

This article is for educational purposes only. It does not replace professional medical advice, diagnosis, or treatment. Always consult a qualified healthcare provider regarding mental or physical health concerns.

Author – Dr. Nirosh

Dr. Nirosh is a medical doctor and active trader who specializes in the physical and mental health challenges faced by traders, gamers, and desk professionals. He combines clinical medical knowledge with real-world trading experience to create practical, evidence-based solutions that improve performance and reduce pain.

👉 Read Dr. Nirosh’s full bio